My Secrets for Buying an Acreage Home

Buying a home can be confusing and even intimidating at times. That’s why the tips and strategies you’ll find in my 8-week series will set you on the right path. It’s my unique approach and a “behind the scenes” glimpse of what you should look out for and consider when starting your own search for an acreage home.

Buying an acreage home can be complex and confusing at times even if this is not your first home purchase. Just like when you made your first or last purchase, you want to make sure you don’t do something wrong. Or, you might worry that you don’t know what you don’t know especially if you’ve only lived in the city so far.

I get a lot of questions from buyer clients about buying an acreage home in today’s market. That’s why I want to provide answers to some of the most common questions so you can become better informed and more reassured. Some of them are from buyers who went before you and the answers helped them to take action one way or the other, so hopefully they’ll help you do the same.

If you have questions that’s not answered here, just remember that no question is ever a “dumb question,” so ask away! Even though each buyer’s situation is unique, you’ll find the question/answer sections below helpful in giving you some insight on what steps might be best for you.

Plus, maybe you’ll also learn something “you didn’t know you didn’t know”!

Q: Do I need 20% down to buy a home?

A: No. Whether this will be your first home, or you want to put less than 20% down. Here is the definition of “first time homebuyer”. Your financial qualification is probably a lot different from your cousin’s but you don’t know what it takes until you talk to a mortgage lender. If you are worried about getting your credit run will do more harm than help, some loan originators can help provide an estimate based on your FICO score instead.

Q: Can I buy a home even if I have student debt and car loans?

A: Of course yes! I’ve helped clients with student debt and other debts to buy their first homes so don’t let that stop you. This will play a part when a lender calculates your “debt to income” (DTI) ratio. In this article, I have an example of how to calculate it in super simplified term if you want to try it on your own.

Q: Is it a good idea to borrow from my 401K?

A: It can be a great idea! If you have been funding your 401k for some time and have a nest egg and want to borrow from it to fund your home purchase, here’s more to it. Keep in mind that this is beneficial in many ways but also have restrictions on the amount you can borrow, purpose of the fund (for a first home purchase vs a non-first home purchase), etc.

Q: Can I buy a home even with today’s interest rate?

A: Yes. Homes are still selling with today’s interest rate and you’ll need a plan on figuring out what you need in a home and how you can qualify and benefit from the best programs out there. Focus on the monthly payment and what that can get you instead of letting interest rate decide whether you can achieve your dreamed lifestyle.

Q: Should I wait to buy a home when interest rates are low?

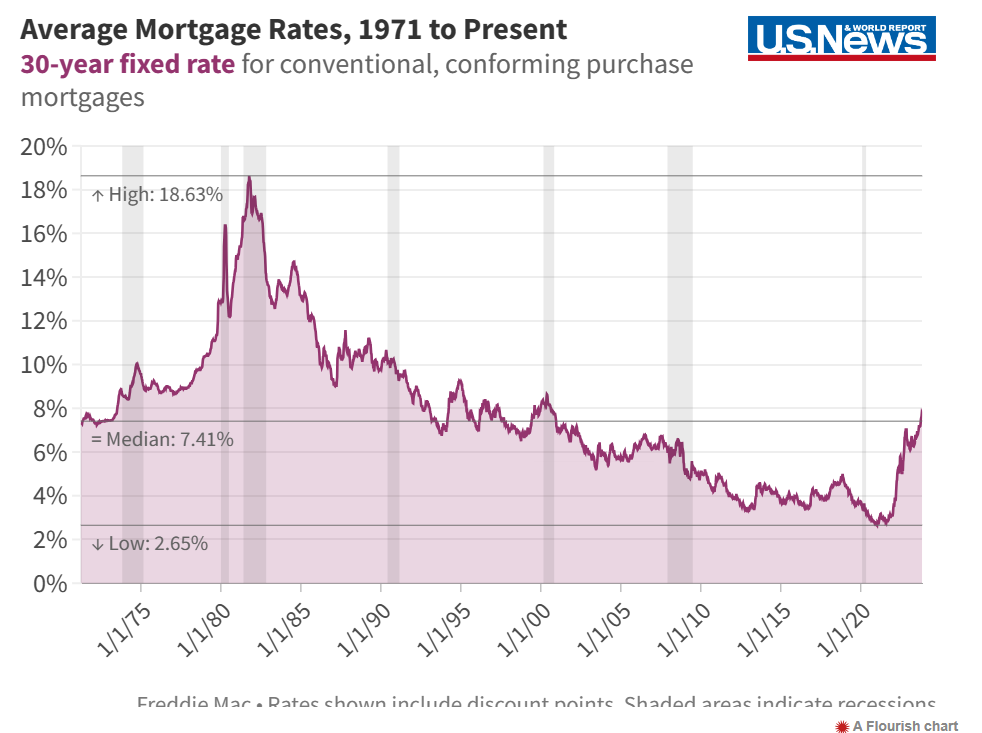

No! Don’t let interest rates dictate your time to buy a home. We are still in a period of historically low interest rates, see the graph below from US News.

Just like buying and selling other investments, such as stock, timing the market is never a good idea. Buy and sell when the time is right for you. Speak with an expert about perhaps which month is best, but always go based on your own timeline and schedule. If you keep waiting, you could be missing out on the time you could be building equity on your home.

Q: What About PMI? What is it and why should I avoid it?

A: PMI stands for Private Mortgage Insurance, and it isn’t as bad as what many people think. If you have less than 20% down payment for a property, that’s when a lender will request a PMI being added to your monthly principal and interest payment. Here is what you need to know about PMI.

Q: Aren’t acreage homes more expensive than a “regular home”? How can I afford one?

A: Not true. There are many affordable acreage homes available in our county and there are different programs to help you qualify for them! One of them is called a USDA loan that encourages home ownership in rural areas and you can put as little as 0% down! You can learn more about USDA loans here.

Q: My credit score isn’t great, how can I improve it?

A: Yay I’m so glad for this question because asking “how” instead of saying “I’ll just wait” is the very first step of making it happen. Here are some free ways to improve your credit. It’s important to continue with some of these tips after you credit score gets to where you want it to be, so that you are making progress towards being the “best borrower” in a lender’s eyes to be able to buy your dream acreage home!

Q: I don’t know anything about taking care of a big property, can this still be right for me?

A: Yes totally! Don’t let it scare you from your dream lifestyle, surrounded by nature, garden and trees, and animals! Check out this blog post 6 Things You Need to Know Before Buying an Acreage Home, but keep in mind that the ultimate decision is up to YOU.

Q: I have to sell a home first to use the funds towards the new acreage home, is there a way around that?

A: Yes! In fact, there are different options to do this where you can buy first then sell (without having to qualify for 2 mortgages at the same time). Just email me “how to buy and sell at the same time” to find out as there are more than one way to achieve this!

Next week is one of my most favorite articles – Is the “Paradox of Choice” Derailing Your Acreage Home Search? I’ll share with you the secrets from this book that can help you focus on making a decision and not being overwhelmed by too many choices. You don’t want to miss it!

Hi, there!

I'm Yue Lehman. I've made plenty of mistakes with my acreage home and would love to help you avoid them throughout your purchase and sale process of an acreage home so you can enjoy the country lifestyle with ease.

Let's Meet

Contact

559-558-3765

hello@yuelehmanrealestate.com

Buyer

My Listings

owner

All Articles

schedule your free consultation